developing a little business enterprise isn’t effortless. Building a tiny business during a as soon as-in-a-life time world-wide pandemic is in the vicinity of-extremely hard. in conjunction with taking care of Competitiveness, advertising and marketing, fiscal management, staffing, and the entire other issues affiliated with running a business, companies that operated in the course of 2020 and 2021 faced the extra problems of functioning a business even though confronting a baffling Website of presidency laws that limited company functions or, in some cases, closed companies altogether.

To reward organizations that retained staff members by means of this tricky time period, the Federal govt established the worker Retention Tax Credit, a refundable credit rating for businesses that continued to pay for employees all through 2020 and 2021. Securing this credit rating can help organizations continue to recovering within the pandemic and assure their continued functions and viability. Moreover, your tiny organization might qualify for an ERTC Advance mortgage, a way to make certain that your online business has the Prepared funds to meet your obligations and take advantage of alternatives for growth.

what's the ERTC?

The Employee Retention Tax credit score (also referred to as the “ERTC” or “ERC”) is actually a refundable tax credit rating for businesses that ongoing to pay for their workers throughout govt shutdowns and slowdowns in business enterprise occasioned because of the COVID-19 pandemic. The ERTC was released as Component of the Coronavirus support, reduction, and financial Security (“CARES”) Act in 2020. The ERC has given that been amended a few independent times: in March of 2020 because of the Taxpayer Certainty and Disaster Relief Act of 2020 (“reduction Act”), the American Rescue system (“ARPA”) Act of 2021, and also the Infrastructure expense and Jobs Act (“IIJA”), also in 2021.

The ERTC provides suitable businesses which has a credit score from specific work taxes. qualified businesses include whoever has seasoned a full or partial suspension of operations on account of govt orders related to COVID-19, or an important decline in gross receipts.

For 2020, the ERTC was readily available for fifty% of the wages paid around $10,000 for every personnel, capped at $five,000 per worker. For wages paid following January one, 2021, and before Oct one, 2022, the ERTC can be applied to 70% of qualifying wages of as much as $10,000 for every quarter — a optimum of $28,000 for every staff via September thirty, 2021.

skilled wages consist of wages and wellness approach bills paid to eligible workforce in between March twelve, 2020, and December 31, 2021. suitable workers incorporate those that were retained and compensated throughout a qualifying interval, regardless of whether they have been actively Performing or not.

what exactly is An ERTC Advance?

An ERTC progress (also known as an ERTC Bridge or an ERTC mortgage) is a short-phrase personal loan that is definitely used to make the resources from the pending software to the ERTC available to your organization straight away. An ERTC Advance can ensure that your online business has the Prepared funds to operate and thrive, and removes the necessity to wait for government approval within your software whilst your application is pending.

though there isn't a Formal timeline for IRS processing of ERTC programs, processing and approval of promises can typically take eight-twelve months. This lengthy processing time can suggest that resources owed to organizations are delayed for months, if not a lot more than a 12 months. Securing an ERTC progress can make sure money can be obtained promptly.

However, securing an ERTC progress bank loan is not really devoid of risk — an software that may be denied by the Internal income support in whole or in part may possibly help it become tough to repay an ERTC Advance. The ERTC is complex. Therefore, it’s significant that businesses trying to safe an ERTC progress make sure that their software is as thorough and airtight as is possible right before securing funding of the ERTC claim. Ensuring that your declare continues to be evaluated by seasoned specialists which is backed by legal investigate and complete assessment can provide stability and peace-of-brain as your small company pursues its assert. At ERTC Funding, we completely Assess and review your assert, ensuring the cash you apply for will be the resources you’ll get.

What Can An ERTC progress bank loan Do For Your Small business enterprise?

the flexibleness of the ERTC Advance financial loan provides a quantity of benefits for a small enterprise. An ERTC progress financial loan can add predictability and security to your company’s cash circulation, making certain that your company has each of the funds you involve to operate on on a daily basis-to-day foundation, without requiring you to definitely look forward to the vagaries of government processing of statements.

An ERTC progress mortgage can also enable your company reap the benefits of alternatives as they crop up, allowing for you to purchase out a competitor, purchase inventory at a reduction, or expand your organization on your own timeline, not the government’s.

How ERTC Funding will help

ERTC Funding is your lover at just about every move of your ERTC application approach. Our proficient, professional group of professionals will carefully examine your declare to make sure you qualify for the utmost refund feasible, total your IRS filing, and get the job done with our network of companions to search out you the very best ERTC Advance financial loan for your small business. your online business can qualify to finance your accepted ERTC declare in as very little as just one to 2 months, ensuring that your enterprise receives the cash it’s entitled to on a timeline that works for your organization.

Doubtful If your online business Qualifies?

The ERC is a complex application, and a lot of employers are Not sure whether they qualify – Particularly On the subject of examining partial suspensions of functions. Thankfully, ERTC Funding is listed here to help you! We’ve assisted numerous purchasers with deciding their eligibility to say the ERC based on comprehensive or Partial Suspension of Operations (FPSO), a Significant decrease in Gross Receipts (SDGR), or as being a Recovery begin-up Business (RSB) – and we might like to help you!

ERTC Funding’s (ertcfunding.com) ERC industry experts, tax professionals and lawful counsel may also help Examine if your enterprise qualifies for the ERC and aid Along with the professing approach. Our proprietary ERC allocation/optimization application might also aid be sure that, if your small business website is qualified, no obtainable resources are left to the desk! As an added bonus, due to oftentimes-important delays in IRS processing of ERC promises, ERTC Funding also offers upfront funding possibilities that may be available if your organization demands The cash now.

Angus T. Jones Then & Now!

Angus T. Jones Then & Now! Ariana Richards Then & Now!

Ariana Richards Then & Now! Kirk Cameron Then & Now!

Kirk Cameron Then & Now! Jane Carrey Then & Now!

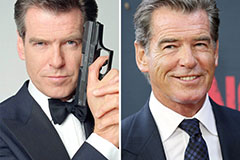

Jane Carrey Then & Now! Pierce Brosnan Then & Now!

Pierce Brosnan Then & Now!